The Meritage Venture Group:

A Triple Family Office

Our Priorities are Planetary and Human Health with a Twist

Why "Meritage"?

The Meritage Venture Group is a Family Office collective who primarily invest directly in Series A/B+ founders and startup teams who are commercializing disruptive innovations responsibly for planetary health and human health.We sift through the hype to focus on transformative, systemic, and scalable solutions based on actionable science and de-risked Technology Platforms with hardware IP or operators who embrace and embrace restorative Nature as Tech.We are most inspired by ecosystems and healing technologies driven by bio-design thinking, regenerative multi-revenue business models and knowledge frameworks, and layered regenerative impact ambition in multiple geographies, inclusively.We believe in healing and evidence-based sciences + responsible technology innovation → novel business models → unique products and service portfolios → outcome-driven stewardship with systemic, enduring value creation.Why Meritage?"Meritage" originates from the wine industry but to us represents a very high-quality and high-integrity blend, merging "merit"— the pursuit of regenerative excellence with "heritage" — a legacy of deliberate craftsmanship and healing methodologies that sustain and restore the web of life.Launching this overarching evergreen and outcome-driven philosophy, The Meritage Venture Group unites 3 Family Offices bound by parental friendships and next-gen minority outcome and tech investing ambitions (children and grand children) to support founders who boldly reimagine and rethink the technology and business relationships we have to our health, bodies and key organ systems, nourishment, living spaces, and ecosystems at regional and thus a planetary scale for generations to come.

What We Invest In

The Meritage Venture Group prioritize direct investment in founders who push the boundaries of disruptive medical technologies that treat and diagnose medical conditions at their root cause and/or promote resilience by restoring nature, reducing waste, and supporting native ecosystem services and circular bio-economies and regenerative agriculture/forestry.Series A+, follow-on growth or GP stakes minority equity investment at top co level is always our preference.

Priority Investment Areas

HEALTH + WELLNESS

• Regenerative Medicine and Biologics

• Minimally Invasive Medical Devices

• Medical and Aesthetics Lasers

• Wearables and Advanced Diagnostics

• Bio-Based 3DP Medical Tools and Tissue/Organs

• Genomics Tools and Products

• Organic Nutraceuticals and Skincare

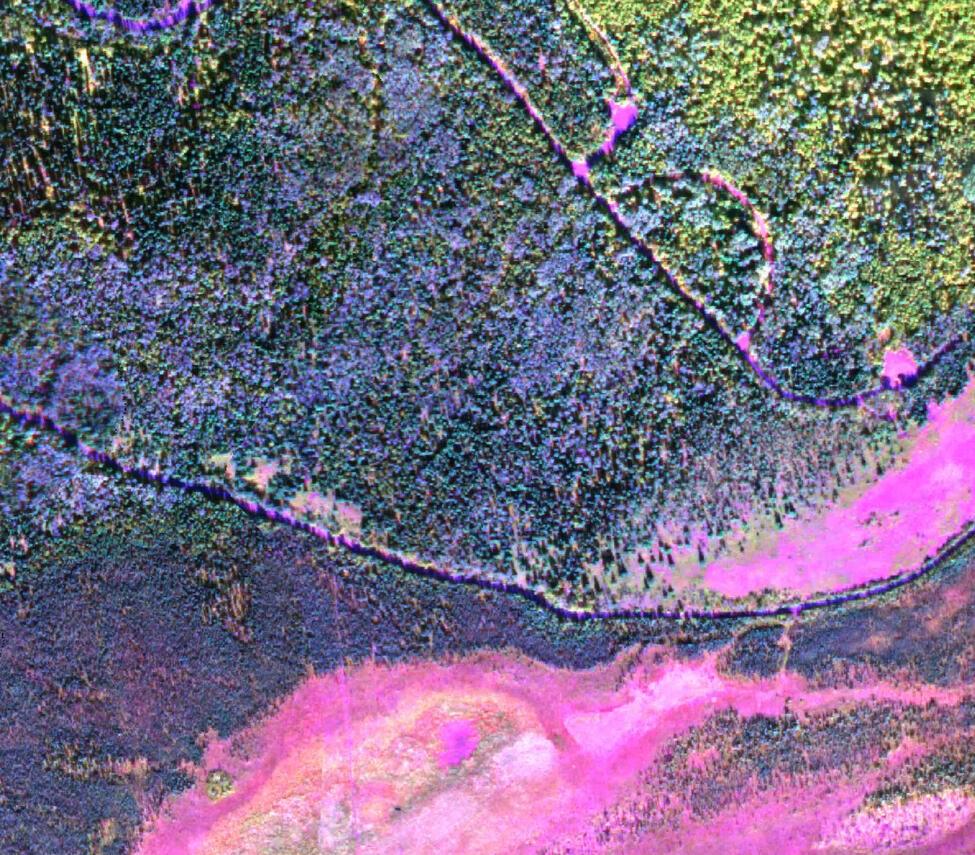

• Hyperspectral Imaging and Multimodal SensorsBIO-BASED MATERIALS & BIO-ENHANCING INFRASTRUCTURE

• Bio-Based Circular Manufacturing

• Nature-Positive, Green Building Materials

• Regenerative Agriculture Systems, Inputs, and Biomaterials

• Sustainable Packaging and Recycling (Pulp, Ag Waste, and Metals)

• Decontamination and Filtration Tech for Air, Water, Soil, and Waste

• Biodiversity-Enhancing / Carbon Removing Concrete and InfrastructureNATURE + CLIMATE RESILIENCE

• Mitigation Banking and Conservation Easements

• Carbon Removal and Natural Climate Solutions

• Biodiversity-Positive, Regenerative (Agro)Forestry and Reforestation

• Native Habitat Restoration, Rewilding, and Assisted Natural Regeneration

• Hyperspectral Imaging for Marine, Soil and Under Canopy Environments

• Environmental DNA and Digital Ecosystem/Biodiversity Monitoring PlatformsASSISTIVE ROBOTICS & RESPONSIBLE AI WITH CURATED PROPRIETARY DATA

• Medical or Ecological Hardware, Tools, or Lab Automation with AI

• Responsible AI with Curated Data for Healthcare, Nature, Climate and Water

• Robotics for Regenerative Medicine, Ag, Nature Restoration, Circular ManufacturingPRINCIPLES AND GUARDRAILS THAT GUIDE US

1. No Value-Destroying Deal Re-Trading & Over Leveraged Deal Structures.

2. Advance Ethics, Anti-Corruption, and Human/Nature Rights at All Levels Beyond Compliance.

3. Augment Health Outcomes to Diagnose and Treat Root Causes with Clinical Evidence, Geographic Reach and Value-Based Access with Wow Effect on Patients and Specialist Doctors.

4. Assure Native Biodiversity-Positive Outcomes in Restoration, Mitigation, Manufacturing/Extraction, and Climate Resilience Investments.

5. Exclude Corporate Oil & Gas, Tobacco/Vape, Exotic Timber or Other Commodity Mono-Culturists with Net-Negative Historical Environmental/Health Impacts or Harmful Subsidies on Same Investor Cap Table or as Corporate Carbon Removal Off-Takers, Natural Capital Asset, Nature Restoration or Mitigation Banking Co-Sponsors.

The Meritage Venture Group is Neither a Foundation Nor Venture Capital.

We represent for-profit, patient family office capital and are optimists, who love to learn, collaborate, and invest in a strategically passive manner.We Invest in Visionary Founders Who Boldly Reimagine Regenerative Technologies & How We Relate to Our Bodies, Health, Climate + Nature.

Have a Bold Tech Vision for Planetary or Human Health? Let’s Talk.

If you’re a Series A/B+ founder with groundbreaking IP, hardware, and regenerative technology ready to commercialize and scale with a novel business model, we want to hear from you about your solutions for planetary and/or human health.And if you’re a GP stakes leader, tech fund (AI, robotics, med tech, ag tech, water tech, prop tech, nature or climate tech), natural capital asset fund or mitigation banker, reach out too. We might co-invest or otherwise find ways to grow or scale up your portfolio partnerships and outcomes.

© The Meritage Venture Group, Marina Grande, 2650 Lake Shore Drive, Suite 2504, Palm Beach, FL 33404. All rights reserved. USA, 2025.

Aenean lobortis at nunc eget condimentum. Donec mollis magna quis sem mollis,